age limit for epf contribution

If you resign from your job before the age of 58 years your EPF account will be inoperative if you do not apply for EPF withdrawal within 36 months from the date you are. April 9 2015 at 1114 am.

Any person of any age can open a PPF account.

. Employer contribution will be split as. Use current and future EPF savings to increase loan eligibility limit. Employment is a relationship between two parties regulating the provision of paid labour services.

As an employee working in a corporate set-up there are several things one would like to know about the Employees Provident Fund EPF. Special rules apply if you open an NPS Tier 1 account from the age of 60 65. Further any interest dividend etc.

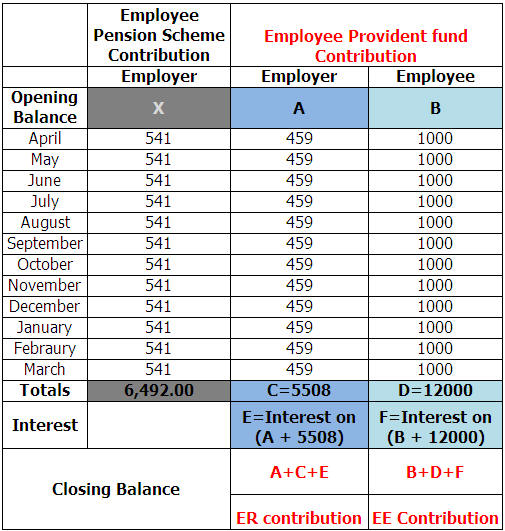

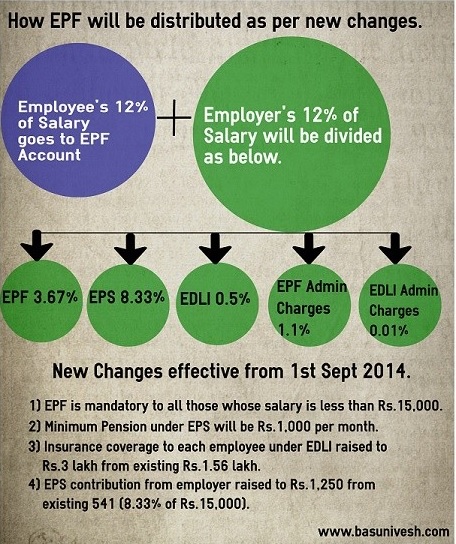

Employee Contribution EPF12 200002400 Employer Contribution EPS833150001250 Difference2400-12501150 Total Employer PF125011502400 Note- Even if PF is calculated at higher amount For EPS we will take 15000 limit only Remaining amount wil go to Difference. Contribution by an employee Contribution towards EPF is deducted from the employees salary. Any extra contribution will go into EPF.

The European Pillar of Social Rights sets out 20 key principles and rights to support fair and well-functioning labour markets and welfare systems. Overall your contribution can continue if you are a full-time employee on a companys payroll. In such a case the Rs 15 lakh maximum deposit limit will apply to your spouse and daughter combined.

The contribution deducted from the employees account is exempted from tax up to Rs 15 lakh. EPF is the main scheme under the Employees Provident Funds and Miscellaneous Provisions Act 1952. Contribution by an employer -The contribution made by the employer is 12 of the basic salary of the employee.

EPFO has issued guidelines regarding when and how TDS on interest will be deducted if EPF contributions exceed Rs 25 lakh in a financial year. As of now the EPF interest rate is 850 FY 2019-20. The minimum amount of contribution to be made by the employer is set at a rate of 12 of Rs.

Earned on the excess contribution is also taxable. EPF Limit increased to Rs. The employer must pay their employees contributions on or.

I-Suri below 60 years of age 3. Of years of service required. You have to be between 18 and 65 years of age.

Example for each employee getting wages above 15000 amount will be 75- 3. The contribution to EPF is reduced to 10 from 12 for non-government organisations. Age 60 and above Malaysian.

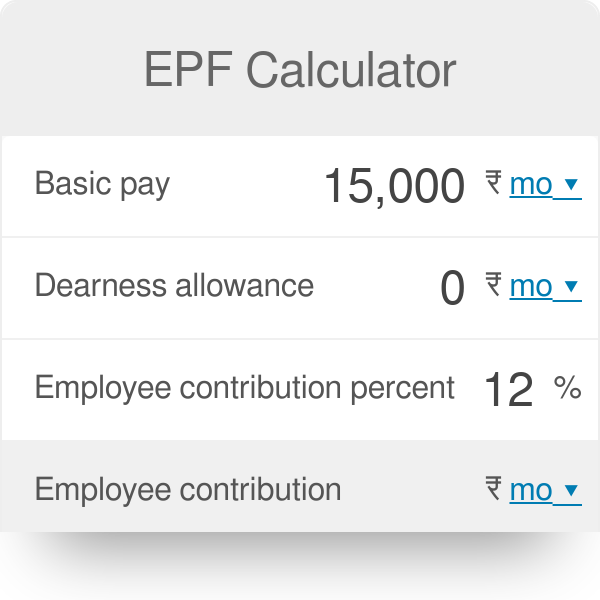

Employees work in return for wages which can be paid on the basis of an. As per latest EPF rules the employee contribution is 12 of Basic Pay Dearness Allowance. However during the period when contributions dont get credited to the PF account the interest rate earned does not remain tax-free.

NRIs can also open it as long as they are Indian citizens. Looking at the importance of accumulating ones old-age savings the voluntary contribution limit will be raised from RM60000 to RM100000 yearly Tengku Zafrul said. Permanent Residents PR Non-Malaysians registered as member before 1 August 1998 No limit.

Usually based on a contract one party the employer which might be a corporation a not-for-profit organization a co-operative or any other entity pays the other the employee in return for carrying out assigned work. Further it has also clarified the information that will be shared between the old and new employer in case of. Delivering on the European Pillar of Social Rights.

Please clarify what is the pension formula after increase pension contribution limit 15000- Reply. Government contribution is limited to members who are below age 60. However if you have a daughter as well your spouse can open an account in her name.

The scheme is managed under the aegis of Employees Provident Fund Organisation EPFO. It does not mention the age-limit for EPF Self Contribution. 15000 although they can voluntarily contribute more.

EDLI contribution to be paid even if member has crossed 58 years age and pension contribution is not payable. I-Saraan below 55 years of age 2. This is your contribution towards your EPF corpus.

According to the notification for the. However in cases of continuation of service the employer needs to pay the Employees Provident Fund Contribution till the date of his or her leaving the service irrespective of the age of the member. Down in Table V or may opt to receive the Scheme certificate provided on the date he has not attained 58 years of age.

Employee EPF Contribution. Contribution to be paid on up to maximum wage ceiling of 15000- even if PF is paid on higher wages. The amount limit is a minimum of RM10 and up to a maximum of RM60000 per year.

According to a Bengaluru bench of the Income-Tax Appellate Tribunal ITAT ruling the interest credited to an Employees Provident Fund EPF account after an individual ceases to be in employment is taxable in his hands in the year of. As per the EPF Act 12 percent of an employees basic salary and dearness allowance has to be invested in EPF and the employer needs to invest an equal sum. Employer contribution will be split as.

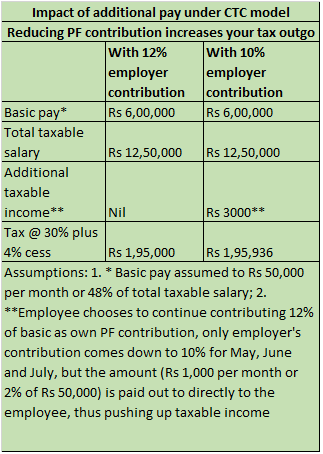

1You have to be a citizen of India. Organizations operating under the wage limit of Rs. It was announced in Budget 2021 that interest on Employees Provident Fund EPF and Voluntary Provident Fund contributions above Rs 25 lakh in a financial year will be taxable.

Employees Provident Fund EPF 367. Recently EPF announced that it recorded its first negative net contribution in 20 years at RM582 billion as members withdrew funds from their EPF accounts to cushion the. The NPS Tier 1 account matures at the age of 60 and you can extend it till the age of 70.

ParentsLegal guardians can open PPF accounts for minors. But this rate is revised every year. PPF Limits for Age.

To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies. Notwithstanding section 51 the Board may transfer to the Registrar of Unclaimed Money all sums of money standing to the credit of a member of the Fund which have not been claimed when such member has attained the age of one hundred years or any age limit as prescribed by the Board whichever is higher. Employers Contribution towards EPF.

EPS contribution will be a maximum of 1250. However this 12 is further subdivided into. The Central Board of Direct Taxes CBDT has on August 31 2021 notified the rules regarding the taxation of the interest on the excess EPF contributions.

As per the announcement made in Budget 2020 if an employers total contribution to the EPF NPS and superannuation fund exceeds Rs 75 lakh in an FY then the excess contribution will be taxable to an employee. Whereas for the other 3 voluntary EPF contribution schemes theres an age-limit. In case of non-restricted contribution PF will be on actual contribution ie 12 of 15500 1860 which is the Employee contribution.

Act now and get rewarded with 15 government contribution. Each contribution is to be rounded to nearest rupee. Top-Up EPF savings Toppeerecipient below 55 years of age.

Employee Pension Scheme EPS 833. This deduction is provided under section 80C of the Income-tax Act1961. This income tax rule is effective from April 1 2020 onwards.

Pf Tax Rules When Does Epf Become Taxable The Economic Times

Epf Calculator Employees Provident Fund

Invest Money Better Employee Provident Fund Contribution

Epf Self Contribution Everything You Need To Know The Money Magnet

Kwsp Epf Sets Rm228 000 As Minimum Target Savings At Age 55

Why Should You Check Your Epf Contribution After Salary Hike Mint

Rates Of Pf Employer And Employee Contribution Pf Provident Fund

14 Faq Epf Contribution Wage Limit Ceiling Simple Tax India

Hrinfo In Epfo Removed Contributions Remittance Grace Period Of 5 Days W E F Jan 16 Wage Month Contributions

Epf A C Interest Calculation Components Example

Lower Pf Contribution Of 10 Percent Is Not Mandatory Epfo Clarifies

Epf Self Contribution Everything You Need To Know The Money Magnet

How To Increase Epf Contributions For An Employee And Employer In Deskera People

Epf Withdrawal Rules 2022 Medical Emergency Home Loan And Retirement Eligibility How To Withdrawal Pf Online And Offline

Withdrawal Of Pf With Less Than 5 Years Of Contribution Know When It May Be Tax Free The Financial Express

What Is Employee Provident Fund Peoplehum

The Complete Guide To Employee Pension Scheme Eps 1995

Malaysia Keeps Epf Employee Contribution Rate Below 11 Pensions Investments

Comments

Post a Comment